In March, wasn’t looking for a new job, but something inside told her it was time to make a career change. Today, as Manager of Employee Experience, a human resources role at Cory Summerhays’ Unforgettable Coatings (UCI) Las Vegas location, she’s glad she made the move, leaving behind a sales position she held for more than 11 years. Along with gaining experience in a new, challenging environment, she has also gained more insight into roof coatings and positive work culture.

“I wasn’t actively looking for a change, but inside I knew I needed one,” she recalled.

The move has turned out to be an even greater blessing in disguise than she initially realized.

Healthcare benefits help a family

Healthcare benefits help a family

Carrejo was impressed with Cory Summerhays’ and the overall commercial roof coating company’s commitment to living out its core values of gratitude for what has been earned, compassion for people, and building trust in the relationships developed with customers, vendors, and others. She was also pleasantly surprised to learn that UCI paid 100% of each employee’s health benefits and that the company even covered dental 100% for the entire family.

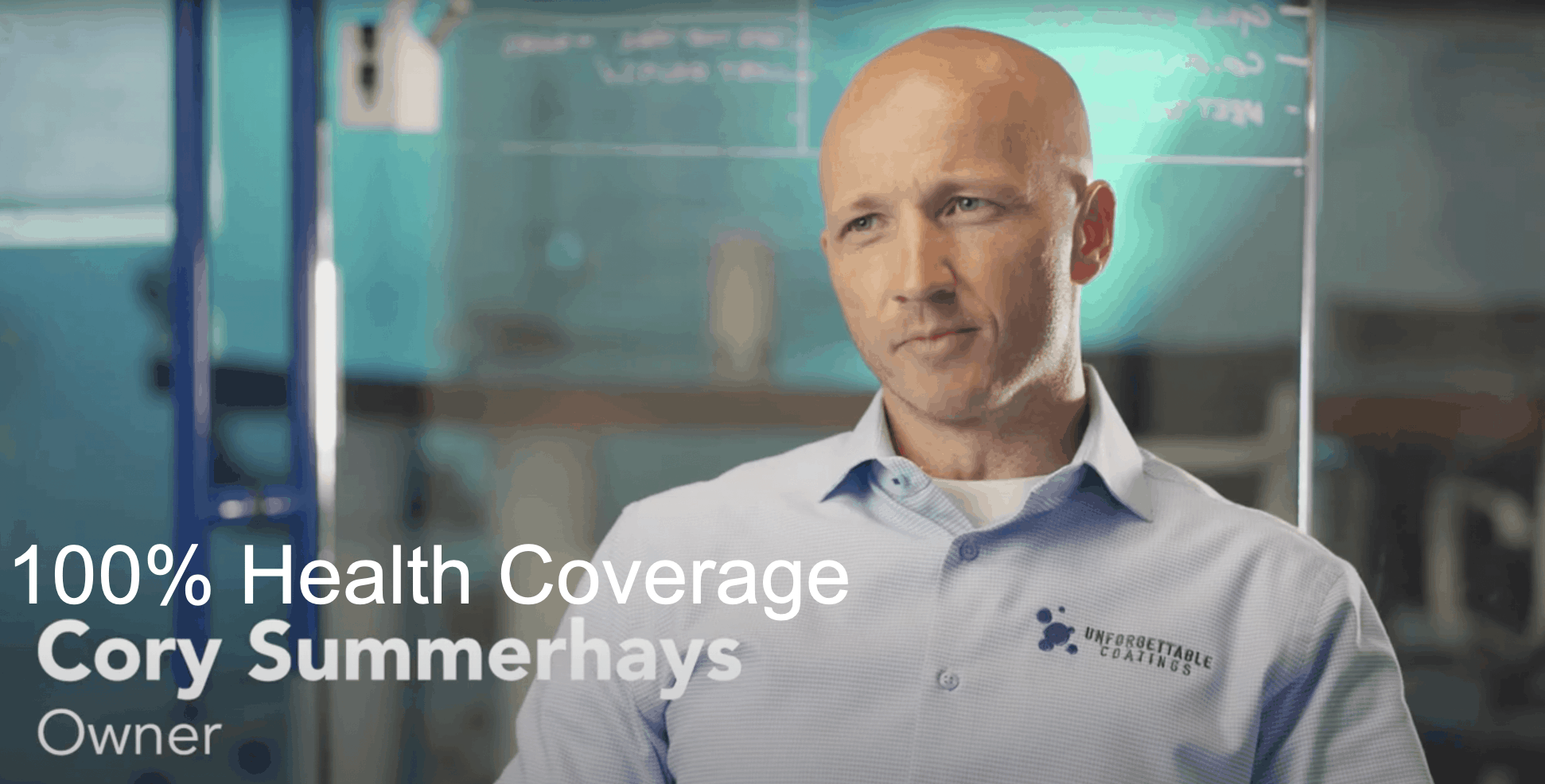

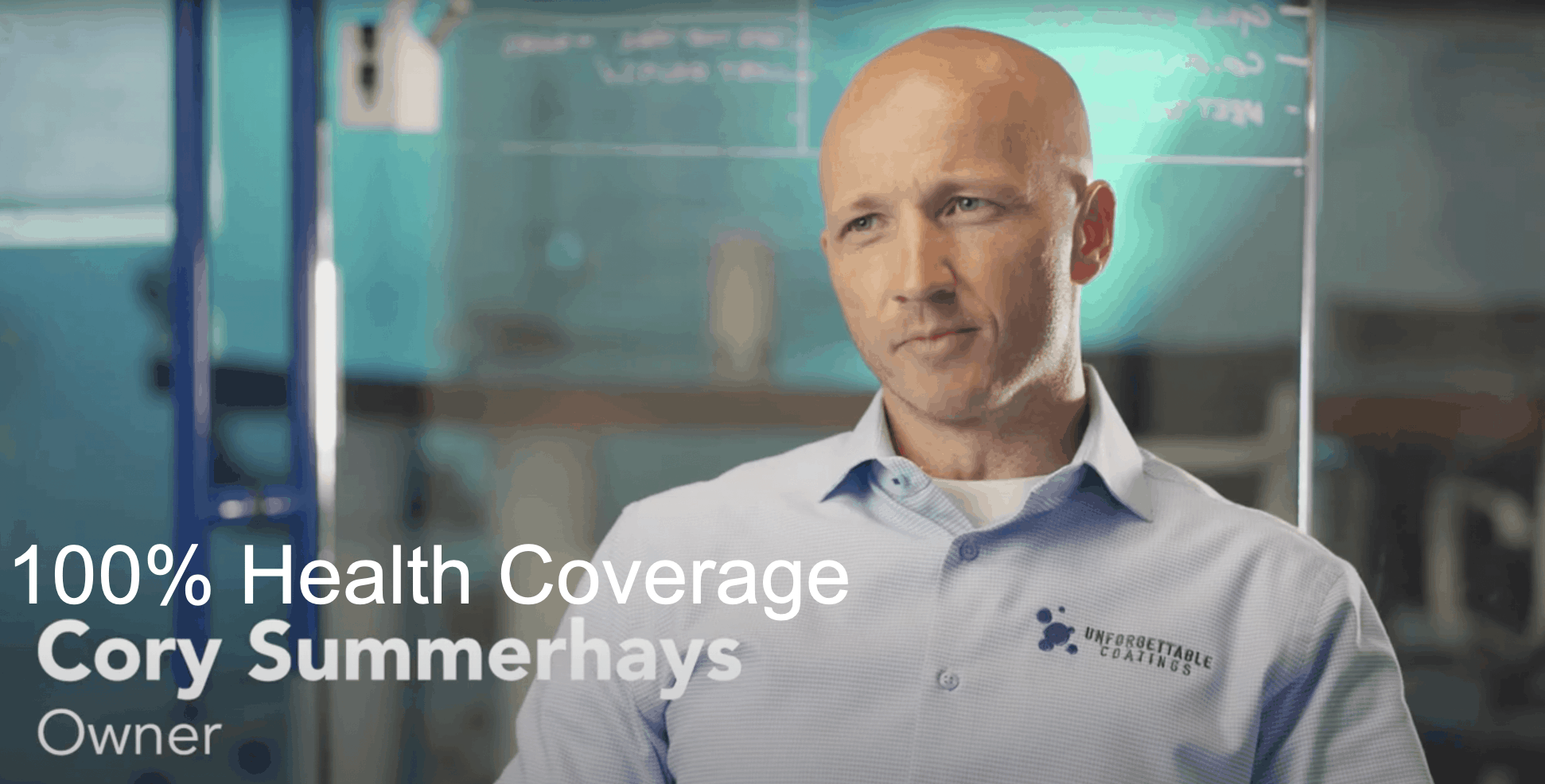

Bothered by low health benefits participation from his employees in the past, Summerhays decided to go all-in for 2020 with a low out-of-pocket, no-deductible, HMO plan that UCI would fully cover for employees. The better plan increased the Nevada roof coating company’s annual healthcare costs by more than $600,000. At the beginning of the year, when he announced the benefit to employees, Summerhays said he saw the move as one way to preserve his team’s ability to offer “unforgettable” customer experiences.

“The way to create unforgettable experiences isn’t just by making sure the paint looks great. It’s the smile, the approach to the relationships that our employees bring. I believed wholeheartedly that they’d be better able to continue to take care of our customers and their families with this decision,” Summerhays noted.

Carrejo would still need to pay for coverage for her husband and daughter, but she noticed lower copays with UCI benefits when compared to her previous plan. And premiums would be about a third of the cost too.

“The reality is when I started looking at the benefits a little bit more, what Cory’s team at Unforgettable Coatings in Las Vegas had was just a lot better. We decided to make a change. They negotiated a really good plan for their employees,” she said.

Of course, like many others, Carrejo didn’t think she would need the benefits; but when her husband was diagnosed with cancer a few months later, she began to see even greater value in her decision.

“Early on, we really didn’t understand the magnitude of our decision. Now, my husband has to go in for treatment every day, five days a week,” she added. “Every single time we go in, we need to pay a copay. … Our out-of-pocket expense is less than half of what it would have been under our old plan.”

Benefits that work for everyone

For Cory Summerhays and Unforgettable Coatings, the move to paying 100% of an employee’s health benefit is the result of a long journey with his insurance broker, Distinctive Insurance, of Las Vegas, who set out to find the perfect plan with small copays that keeps dollars in employees’ pockets.

He was cautioned by some that the move to make such a generous contribution to employee healthcare would be a gamble, especially as the pandemic took hold and everyone on the team needed to make sacrifices.

“On paper, they said we would need to cut costs, including my whole salary,” he said. “I’m confident the intangibles of the move are clear. Results include better performance, a better experience for all, a better brand. The ‘gamble’ stays true to our mission and I’m proud of that, regardless of the outcome.”

Carrejo, a native of Mexico, says it’s important for other immigrants in the company to understand the value and need for the benefits package.

“Latin culture typically is not one that understands these benefits so much,” she explained. “As a community, we typically don’t think much about health insurance and how the benefit of having it is tremendous. … It’s the impact of having a regular doctor visit and how it can change your quality of life. Those preventive measures are why we were able to detect my husband’s cancer in time.”

Summerhays is proud that the move brought blue-collar worker benefits in line with executive benefits. He hopes his decision inspires other businesses to follow suit.

“I think a decision like this is just good business,” he added. “If you take care of the people, they will take care of the client and everyone wins.”